EMERGENCY Bank of Canada rate cuts? What does this mean?

Is your head spinning seeing headlines about EMERGENCY Bank of Canada (BoC) rate cut and wondering what this means for YOU?

It’s hard enough to understand how regular interest rates work... so no one will blame you if all of the news about these unscheduled rate cuts are confusing you! Keep reading to gain a better understand on WHY the BoC has been slashing their rates and better yet, how do these cuts translate into Mortgage rates...

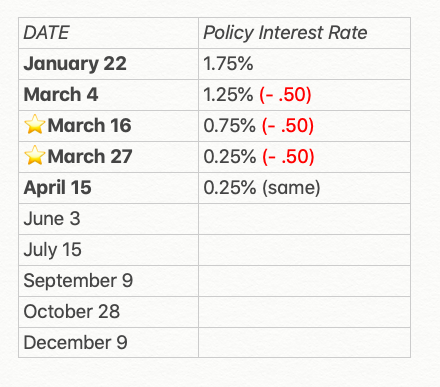

First of all, in March we saw THREE rate cuts. The first one was scheduled & happened on March 4th. The rate went down 50 basis points. From 1.75% to 1.25%. The next two were unscheduled and said to be a proactive measure in light of the shocks to the Canadian Economy arising from the COVID-19 Pandemic and sharp drop in oil prices.

The first unscheduled cut was on March 16th and then again on March 27th. After all three cuts the BoC target for the overnight rate went down by 50 basis points each time, all the way down to .25%. (lowest it has been since April 2009). The Bank continues to work on a number of initiatives to support the Canadian economy during these volatile times (you will read about this at the end of this post), experts believe this will be the final rate cut in response to the pandemic.

EMERGENCY rate cut?

The BOC has a system of EIGHT fixed dates throughout the year which they announce whether or not it will change the policy interest rate (March 16th & March 27th were both unscheduled) It’s considered an “EMERGENCY” measure since it falls outside of the Banks regular scheduled rate announcements.

(.50 is equal to 50basis points. In March the Policy interest rate was lowered by a total of 150 basis points) What is a basis point? one hundredth of one percent, used in expressing differences of interest rates. AKA 50 basis points is equivalent of 0.5%, as 1 basis point is one hundredth of 1% or 0.01.

Important Notes:

⭐️April 6th Changes to the Stress Test were suppose to be announced- this has been put on hold

⭐️APRIL 15th is the next scheduled announcement. The BoC plans to make a full economic outlook (remained the same at .25%)

What is The Role of the Bank of Canada

First of all the Bank of Canada is a crown corporation, which means it is owned by the federal government. It is our Nations Central Bank.

OKAY NOW, lets really simplify this!

At the heart of the Bank’s monetary policy is a commitment to maintain low and relatively stable inflation. In particular, to keep the rate of inflation close to the 2%. A midpoint of the 1-3% target range.

Key Points:

⭐️The Bank of Canada lowers rates to stimulate the economy making it as easy as possible to borrow, spend & invest

- On the contrary the Bank of Canada will raise interest rates in an effort to reduce how much Canadians spend and how much personal debt we take on. This translates to stabilizing housing costs because the more interest we have to pay when we borrow money, the less we can borrow.

⭐️When the Bank of Canada changes its interest rates, it does not affect Canadians with fixed rate debts

⭐️ Bank of Canada rate is the BENCHMARK *If lenders choose to follow suit and change their prime interest rate- this leads to a change in variable interest rates. Some forms of debt that might have variable rates include mortgages, lines of credit, car loans, student loans, and credit cards.

Does the BOC set all Interest Rates?

NO ! The BOC only sets the Target for the Policy Rate (Also referred to as: The overnight rate, the Benchmark Rate).Think of the BoC’s Overnight Lending Rate as a benchmark – Major financial institutions such as TD, RBC etc. set their own prime rate, influenced by the BoC rate.

BoC has a vested interest in the Interest rate

The Bank of Canada sets its key policy rate (or target for overnight rate) eight times each year. You’ll often hear about it on the news – as there is much speculation before each announcement on how much or even if rates will go up or down, and what it means for Canadians. If the Bank of Canada needs to increase inflation, it will drop its overnight rates. This allows banks and lenders to lower their mortgage rates, car/personal loan rates, and credit card rates, which encourages companies and individuals to borrow money. The theory behind it is that Canadians will spend more when it costs less to borrow money. This usually increases demand for products and services, and boosts the economy as well as inflation. On the flip side, if the BoC needs to decrease inflation, it raises its overnight rates. This way, people will be more cautious about borrowing, and it also helps cool hot markets – including the housing market. One growing concern is that Canadians have an increasing amount of personal debt load, and organizations like the Bank of Canada want to avoid the potentially catastrophic impact it will have on the country if interest rates rise drastically. When people are saddled with debt, the economy can come crashing to a halt.

Each time the overnight rate changes, banks and lenders follow suit and change their lending rates accordingly. Although many people believe that the Bank of Canada’s rate is the sole determining factor for whatever rate the banks use, this is not always the case. Banks and lenders also look at additional factors such as the various financial markets, political situations worldwide, trade policies, as well as the strength of the borrower’s application and credit history. The Bank of Canada does not set the rates for lenders, it just guides them; that is one reason why you’ll see a difference in rates between the various banks and lenders.

Now likely, if you came across my blog this is the information that you came here for!

What does this mean for Mortgage Borrowers?

The Prime rate in Canada is (currently as of April 7, 2020) 2.45%. Mortgage rates are STILL historically the lowest they have been! When the rate cuts began in March there were some of the best refinancing deals we’ve seen in years. Click here to read Synergy Mortgage Groups Blog, for more detail on how this will effect you/ your mortgage.

Spring is typically the busiest home buying and selling season. We will definitely be seeing a pause in the activity as expected, with a decline in new listings and less active buyers. Social distancing in place as well as a huge increase in unemployment are major factors in this.

Interest rates on new mortgages INCREASING despite Bank of Canada rate drop?

Both fixed and variable rates have moved higher as of late. Fixed and variable mortgage rates have both risen because lenders have (understandably) added significant risk premiums to their lending spreads. ‘With Canadians losing their jobs, lenders are building a bit of a higher risk premium into their mortgage rate’ Says James Laird ratehub.ca

Banks and other mortgage lenders have been frantically raising rates since last week due to liquidity concerns and heightened credit risk. That’s because they’re based on bond yields and liquidity in the market. Banks are concerned about liquidity and defaults right now, plus, let’s be honest, banks are in the business of making money. This is why you may have seen interest rates creeping back up as of late.

There have been many measures to help Canadians you can read more here. Ranging from deferral of mortgage payments- relief on hydro bills. In this industry we are moving quickly to adapt to changes. Check in with me frequently if you have any questions as things are rapidly changing. We came into this crisis with a very strong foundation. We are expecting a pause in the Canadian housing masker as governments are expanding social distancing. Click here to read more on what experts day about how COVID-19 will impact Canadian home buying.

This portion of the blog goes a little bit more in depth on mortgage related announcements and how OFSI and CMHC have stepped in to minimize trauma to the economy…

Fiscal and monetary policy action that has been implemented to minimize economic trauma inflicted by the virus.

1. On March 16 the Canada Mortgage and Housing Corporation (CMHC) announced that it would purchase $50 billion worth of insured mortgages from lenders in order to free up their balance sheets for additional lending. On March 20 it announced that previously uninsured mortgages would also be eligible, and then last Thursday, on March 26, CMHC increased its planned budget to $150 billion. (To put that in perspective, $150 billion works out to about 80% of all of the insured mortgages currently sitting on our lender’s balance sheets.)

2. March 16th CMHC also announced that the Canada Mortgage Bond (CMB) program’s current limit of $186 billion will be increased by up to $60 billion. Our lenders love the CMB program because it allows them to borrow at virtually the same rates that our federal government pays on its Government of Canada (GoC) bonds. It only goes so far though. Lenders have caps on how much they can sell into the CMB program. When they hit their limit, they have to use other, more expensive funding sources. This announcement gives lenders expanded access to their cheapest funding source.

3. March 17th the Office of the Superintendent of Financial Institutions (OSFI), our banking regulator, announced that it will allow our largest banks to reduce their capital buffers from 2.25% to 1.00%. It estimates this move will increase overall lending capacity by $300 billion. OSFI also confirmed that loans with payments being deferred as a result of COVID-19 will not be counted as non-performing.

4. March 17th, the Bank of Canada (BoC) announced that it would purchase $5 billion worth of federal and provincial government debt per week and will continue to do so “until such time as the recovery is well underway.” The Bank’s primary objective is to ensure that there will always be a liquid market for our government debt, meaning that it can be bought and sold quickly and in large amounts. The BoC’s ongoing interventions will put downward pressure on GoC bond yields (which our fixed mortgage rates are priced on).

5. In addition, the BoC committed $24 billion to our short-term commercial paper market for the same reason – to give buyers and sellers confidence that there will always be a liquid market

The world is quickly shifting as we see the impact of the COVID-19 pandemic shift our global economy. Almost every industry (if not all industries) are facing many challenges during this time!

If you have any questions or comments, reach out anytime!

Sarah Donnelly

sarahdonnelly@rmxemail.com

(289)441-4248

Sources:

Click here for updates on how COVID19 could impact your finances https://www.lowestrates.ca/covid-19

Bank of Canada Press Release https://www.bankofcanada.ca/2020/03/press-release-2020-03-27/

Mortgage Deferral https://www.cmhc-schl.gc.ca/en/finance-and-investing/mortgage-loan-insurance/the-resource/covid19-understanding-mortgage-payment-deferral

OFCI https://www.osfi-bsif.gc.ca/Eng/Pages/COVID-19.aspx

.png)

Post a comment