Everything you need to know about CMHC's First Time Home Buyer Incentive

Friday Aug 23rd, 2019

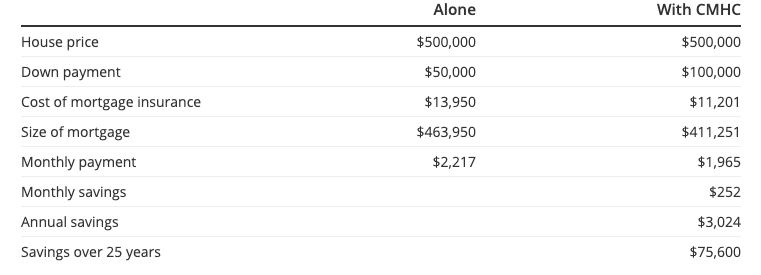

The federal government wants to make home ownership more affordable for young people and to do that it’s introducing the First-Time Home Buyer Incentive (FTHBI) this September. The $1.25 billion program, announced as part of the March federal budget, involves the government buying equity stakes in homes purchased by qualified home buyers, allowing for smaller mortgages that will keep monthly payments lower.

But how will the plan work? Below, we break down all the key details and take a look at who this new program is right for.

How the FTHBI works

The program will be administered by Canada’s housing agency, Canada Mortgage and Housing Corp. (CMHC), which will pay 5% of the purchase price for an existing home, and up to 10% for the value of a new home, in exchange for an equity stake. Once the homeowner sells, they’re obligated to repay the CMHC.

The fine print includes the following:

• To qualify, you must be a first-time home buyer.

• Buyers must have a down payment of at least 5% of the total purchase price, up to 20%.

• The household’s income must be under $120,000, and the mortgage and incentive amount together can’t be more than four times the household income.

• Only insured mortgages will be eligible, meaning this will be restricted to those with a down payment worth less than 20% of the purchase price.

• Buyers will not be exempt from federal “stress test” regulations (a mandatory mortgage qualification using the five-year benchmark rate published by the Bank of Canada or the customer's mortgage interest rate plus 2%)

Who is this for?

The program is for purchasers looking for a starter home but aren’t able to afford the monthly payments needed for a mortgage below $500,000. To qualify for mortgages in the $400,000 - $500,000 range, the household income would have to be close to six figures. Buyers would have to be willing to give up at least 5% of the value of their home to the federal government in exchange for lower monthly payments.

As an example, a couple earning up to the household income cap of $120,000 with a down payment of 5% on a new home would be entitled to an additional $48,000 provided by CMHC, as below:

|

Couple earning $120,000 |

|

$480,000 total purchase |

|

-$24,000 down payment |

|

-$48,000 matched by CMHC (10% for a new home) |

|

= $408,000 mortgage |

As both the household income and total purchase price are capped under the program, it’s worth noting that buyers with good credit and low debt might actually be able to borrow more money than the FTHBI would allow.

In this scenario, “the program forces you to buy less home than you otherwise would be able to. Whether consumers are disciplined enough to take part of that or not is the real question,” says Paul Taylor, president and CEO of Mortgage Professionals of Canada.

Buyers in the program will also want to consider the future value of their home over time. Is the neighbourhood likely to increase in value? With a 5-10% equity stake in the home, CMHC will be along for the ride, both in the case of depreciation or appreciated value of the home.

Post a comment